ipopba/iStock via Getty Images

Will SoFi Technologies (NASDAQ:SOFI) post a consensus beat in Q2 amid recession fears and rising interest rates?

Reassessing valuations in the fintech and payments sector, Credit Suisse Analyst Timothy Chiodo downgraded certain technology companies on recession fears or the lack of exciting developments to propel the stocks upward.

The sector has been under pressure since Q4 2021 by rising interest rates, inflation, general macro weakness, geopolitical impacts from the Russia-Ukraine war, and foreign currency exchange headwinds, among other factors, he had said.

However, Chiodo has rated SOFI Neutral.

Additionally, the Federal Reserve raised its key interest rate by 75 basis points last week, with the Federal Open Market Committee having said it’s “highly attentive to inflation risks.”

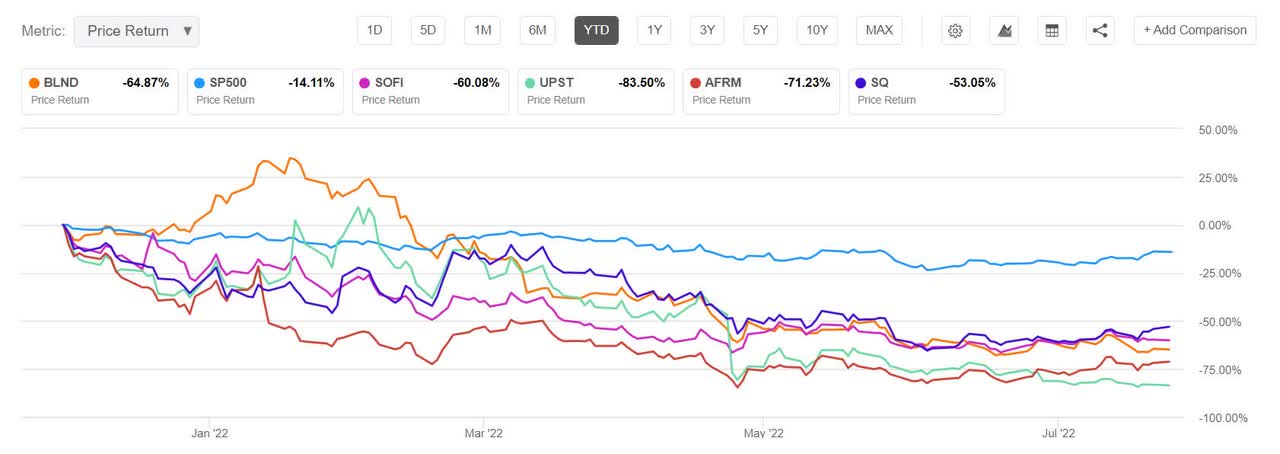

Since the beginning of 2022, returns from fintechs such as SoFi Technologies have been hit hard in the wake of a rising interest rate environment. Large rate hikes could bode poorly for such companies because funding/borrowing costs would further rise.

Here is a look at the year-to-date returns from selected fintechs vs. S&P500:

SOFI is scheduled to announce Q2 earnings results on Tuesday, August 2nd, after market close.

The consensus EPS estimate is -$0.10 and the consensus revenue estimate is $344.47M (+45.2{2eb888e9692bbd3edb43dc8e94410c11cbb5ed42fe61b7e0cb02297f4c001e1d} Y/Y).

Over the last 3 months, EPS estimates have seen 0 upward revisions and 3 downward revisions. Revenue estimates have seen 2 upward revisions and 4 downward revisions.

Recent earnings Analysis from our contributors: SoFi: Expect A Massive Move